Worst-case scenario for the Israel-Iran conflict

In this continuously updating blog we map the worst-case scenario

In this continuously updating blog we map the worst-case scenario

Our December 2021 special report on the Great Reset included

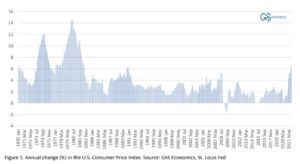

In summer 2021, we started to be rather worried. The

Some think that the arrival of economic crises, or economic

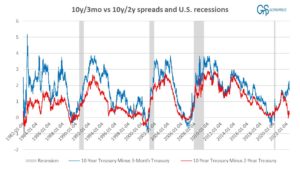

Asset markets in the U.S. are flirting with a ‘bear

Something that many thought could not happen in our lifetime

During this year, we have awakened to a completely new

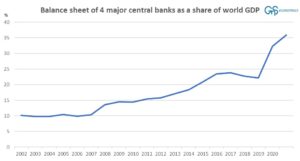

We have been highly critical of the ‘unorthodox policies’ of

In the March issue of our Q-Review series we warned

We continue our financial history series by going through the

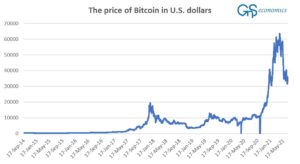

Cryptocurrencies have experienced a remarkable rise in numbers and popularity

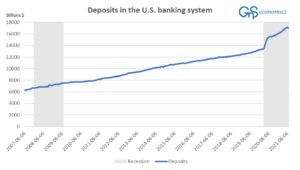

Banking is at the heart of modern economic systems. The

Recent Posts

Archives

Categories

RSS

https://gnseconomics.com/en/feed/