Q-Review 4/2019: Into the Abyss

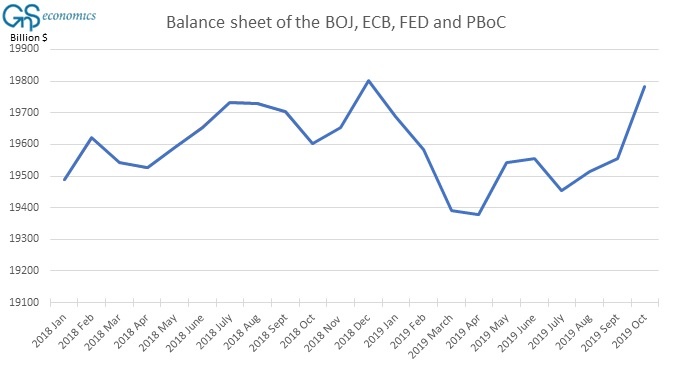

The economic calm which has succeeded the turbulent conclusion to 2018 was abruptly shattered on the 16th of September. On that day, rates in the repo markets spiked by 248 basis points to more than double the overnight lending rate of the…