The U.S. has been an exception in a slowing global economy for the past year. However, it cannot escape the coming global recession and economic collapse.

While the source of the true crisis likely lies in the European banking sector, the corporate debt and stock markets of the U.S. are clearly in a bubble. The banking sector of the U.S. is also “stable” only according to selected metrics that actually fail to account for the overall vulnerability of banks. Due to these elements, the U.S. is vulnerable to a heavy blow from the coming global economic crisis.

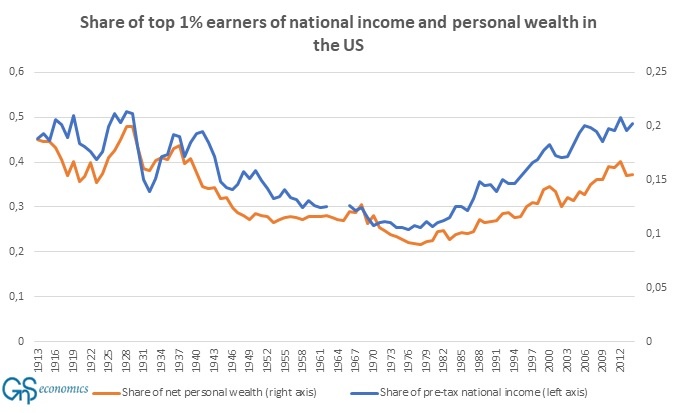

What makes the problem even more perplexing for the U.S. is the fact that income inequality has reached levels not seen since before the onset of the Great Depression. This means that when the recession and crisis hits, it is likely to be multiplied due to massive increases in both corporate and personal bankruptcies, like in the 1930s. This creates a dangerous social tinderbox, which could ignite in the antagonistic political environment prevailing in the United States.

Given these risks, there are several aspects investors need to consider when preparing for the coming crisis—especially as it will almost-certainly create the buying opportunity of a lifetime. In past, less-extreme cycles than this one, investors have made fortunes by buying high-quality assets when prices were the most depressed.

The coming crisis thus may also create an extraordinary opportunity. In this report, we guide those investing in U.S. capital markets how to best benefit from what we see coming.

Buy the Crisis Preparation III: The United States -report detailing, how to prepare for the crisis in the US fromGnS Store

Purchase annual subscription (4 reports) of our Q-Review reports with the access to all previous reportsGnS Store