The finance ministers of the Eurozone are negotiating on the implementation of the rescue package agreed two weeks ago. The only problem is that no one seems to know what was actually agreed. The text of the agreement was extremely vague. This is for the simple reason that political cohesion has nearly vanished from the Eurozone.

This is extremely troubling, as political will, or cohesion, is the glue that keeps currency unions together. When it disappears, currency unions break apart. That’s the unanimous lesson of previous currency unions.

In this blog we detail why the Eurozone has reached its present perilous state, and why it’s unlikely to survive the coming crisis.

“The Greeks are coming!”

The unfortunate fact is that if European leaders had let Greece fail and the banking crisis run its course in 2011/2012, most of the problems now haunting the Eurozone would, most likely, have been resolved by now.

In 2011, the balance sheet of the ECB was practically unimpaired, political cohesion supporting the euro was strong, and the world economy was growing relatively fast—since Chinese stimulus was still effective. Now, seven long years later, the balance sheet of the ECB is distended, European political cohesion is under stress, and global growth is stagnant—with Chinese stimulus impotent.

What would have been a regional banking crisis seven years ago has now turned into a monster threatening the whole global financial system. We have described the dire straits of the European banking section in our previous blog.

A likely trigger for the next stage of the ongoing Eurozone crisis will be a bank run in some corner of the Eurozone. It may be either silent (through “repo” markets, etc., as in 2008) or more obvious with savers visibly withdrawing their money.

If the first significant bank failure occurs in a strong euro member, such as Germany, its initial effects may be contained. But it will breed even greater mistrust of the European banking sector, and, at some point, bank runs will commence on a larger scale and in weaker member states where the outcome will be anything but benign.

The options for the euro

The European banking union has the resources to handle the failure of few small-to-medium sized banks, but not a “systemically important financial institution” (“SIFI” in Fed language). That’s why the responsibility for bank recapitalization will, once again, fall on national governments.

This leads us to the crucial questions determining the fate of the Eurozone, which we outlined in Q-Review 3/2019:

- Will the ECB be able to provide support for sovereign bond markets through QE and the banking sector, and will it be enough?

- Will national authorities co-operate and accept the terms associated with possible bailout loans?

- Will national political leaders, in turn, continue to support the euro?

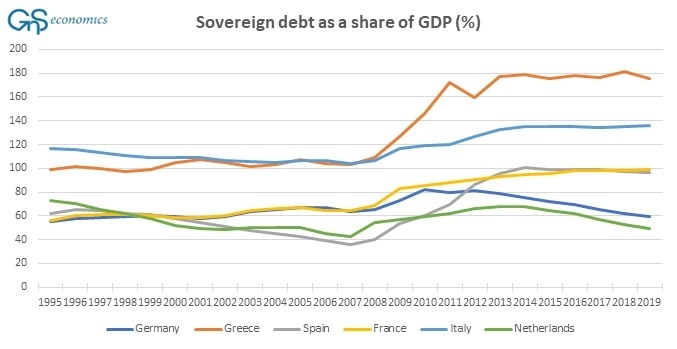

Currently, the ECB is running “unlimited QE”, and so the support for the European sovereign bond markets is in place. This is crucial as many Eurozone countries have a very high sovereign debt burden (see Figure 1).

National authorities have also co-operated and agreed, at least on paper, about bailout loans. How strong the current commitment is remains to be seen.

The risk exists that if eventual bailout loans are conditional upon demands for austerity, citizens of bailed-out countries might see EU institutions as oppressors because of such externally-imposed austerity. Citizens of creditor countries, on the other hand, would object to having their taxes used to bail-out banks of other “profligate” countries.

Political mutiny, manifested through radically-populist parties, would almost certainly erupt. Demands for a euro exit, in Italy for example, could lead to a collapse in political support for the euro more broadly.

The extremely risky “get-out-of-jail” card

If Germany, Finland, the Netherlands, or other “northern” countries agree to significantly increase the budget of the Eurozone in the range of 20%-30% of Eurozone GDP, and to issue Eurozone bonds, they might be able to muster enough firepower to stem the crisis. However, there’s extremely limited support for this in most of the stronger nations, and for good reason, as it would impoverish the whole continent!

For example, in Finland there’s absolutely no support for further federalization. The political backlash would likely be overwhelming.

Realizing a true federal union without the broad and popular support of the citizens of Europe would also be an extremely risky endeavour. It would also violate the constitutions of many member countries as well as Article 125 of the Treaty of the Functioning of the EU, or TFEU, setting the stage for an existential constitutional crisis in the EU. That is why this option continues to be a very unlikely outcome.

Also, if the ECB and/or national governments suffer losses from their loans to other countries of the Eurozone, this would indicate clear violations of Articles 123 and/or 125. This could also precipitate a constitutional crisis in the European Union and make the recapitalization of the ECB far from certain.

The end is near

The unfortunate fact is that the European common currency, euro, has been an ill-conceived project from the beginning. If the history of previous failed currency unions teaches us one thing, it’s that you never ever establish a common currency among countries with very different cultural and political backgrounds without a Federation. It’s unfathomable that we need to learn this lesson the hard way, again!

The massive economic blow caused by the Covid-19 will, most likely, bring an end to the euro. This is something we all should acknowledge and prepare for. It will be the biggest financial earthquake ever, requiring some serious hedging and planning. We have outlined such practices in our Crisis Preparation series.

To end on a positive note, when the euro is gone, former member economies will be ready to accelerate. It will, naturally, not start for a while, but when many export-dependent nations recover their most important macroeconomic stabilizer—their own currency—this will help foster recovery.

And, we should never mourn the passing of those institutions whose time has come!

Order the annual subscriptions of our Q-Review reports, where we detail the developments in the Eurozone, the US and the world economyGnS Store

Check all our services and products from GNS Store