Blog

Black Swans on Black Friday

2020-11-26

On this ’Black Friday’, it’s good to remember that we

Into the Global Economic Dystopia?

2020-11-11

When we first published our scenarios describing global economic collapse

End of the year offer for new Q-Review subscribers

2020-11-07

The most acute stages of the ongoing global economic crisis

The second wave of the Coronavirus is here. What next?

2020-10-17

In May, we published a Special Report detailing the potential

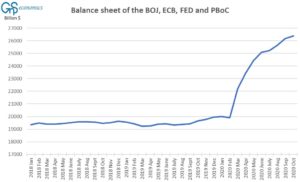

The destruction of the world economy by the Central Banks

2020-10-08

For years, we have been warning about dire consequences if

The scenarios of the collapse: 2020 update

2020-10-03

In December 2018, we first published the scenarios which described

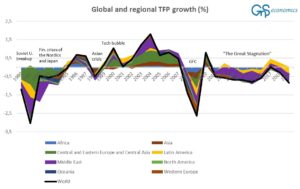

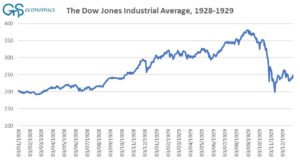

Are we heading to another ’Great Crash’ (of 1929)?

2020-09-23

Stock markets have been wobbly of late. The peak in

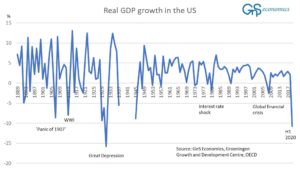

There is no recovery

2020-09-08

We have been watching, with disbelief and bemusement, how the

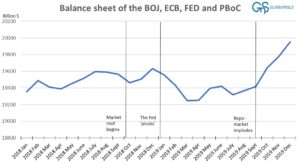

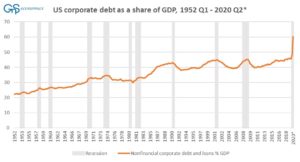

The Fed and the looming capital market meltdown

2020-08-28

The Federal Reserve system made a future financial panic or

The anatomy of a financial crisis

2020-08-24

In this blog, we present the anatomy of a financial

Recent Posts

Archives

Categories

RSS

https://gnseconomics.com/en/feed/