Financial markets are becoming unhinged

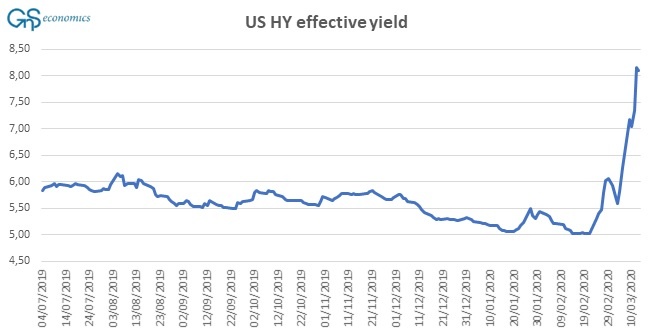

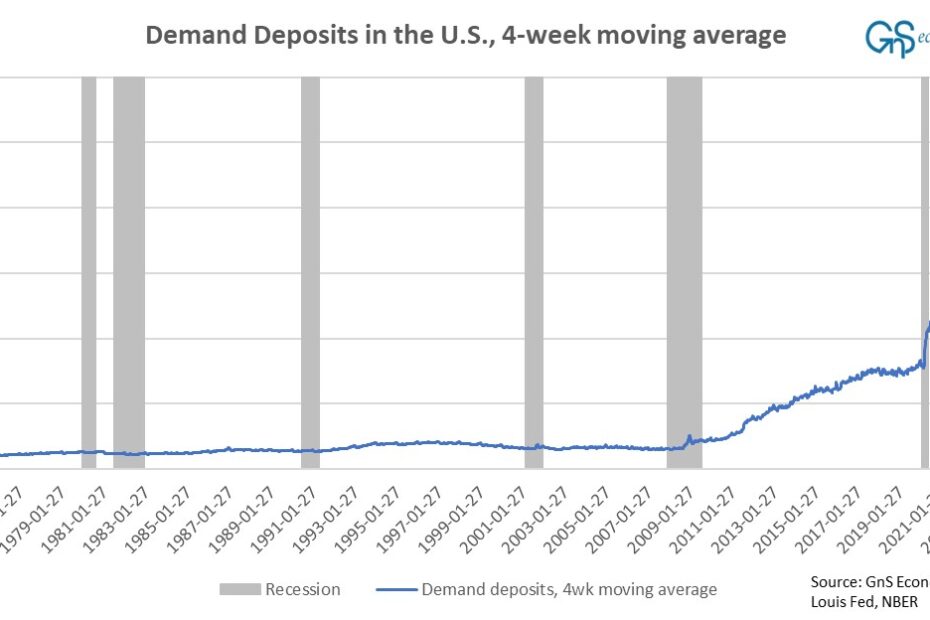

The massive emergency easing measures enacted by the Fed over the weekend to inject liquidity into the global financial system are a sign of sheer panic. Both their sheer scale, and radical extent–including cutting rates to zero, $700 billion in new…