The European Monetary Union (EMU) has been a bold, but fundamentally-flawed experiment. It has sown the seeds of divergence in economic well-being, politics and it has “zombified” the banking sector in Europe. For investors, it has created the possibility of a nightmare scenario concluding in the biggest currency failure in modern history.

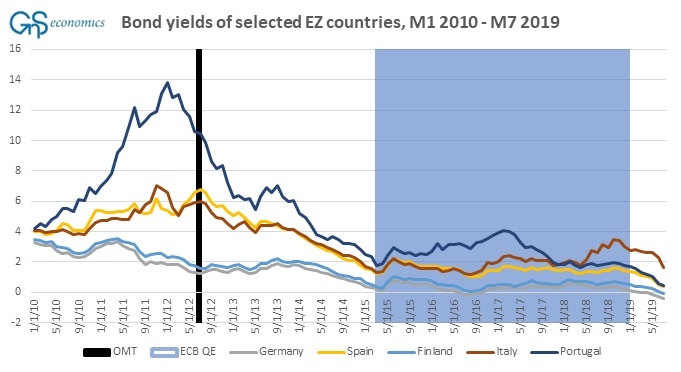

The very high accumulation of debt after the 2008 crisis and, especially, unnaturally low interest rates (see the Figure) have created an extremely precarious investment and operational environment in the Eurozone. A teetering banking sector and highly-indebted sovereign states create additional, and severe threats.

Figure. Yields of sovereign bonds with 10 -year maturity and the announcement of the Outright Monetary Transactions (OMT) program and the QE -program of the ECB. Source: GnS Economics, ECB

Despite the risks, investors, households and corporations need to operate, live and invest in the Eurozone. Given the heightened state of risk, what do they need to take into account, and what are the best ways to safeguard assets there?

In this crisis preparation report, we analyse the situation in the Eurozone and provide guidelines for asset safety in Europe. The Eurozone will face the biggest challenges in the coming crisis, and everyone should be prepared!

Buy the Crisis Preparation II: The Eurozone -report detailing how and where to seek for asset safety in the Eurozone fromGnS Store

Purchase annual subscription (4 reports) of our Q-Review reports with the access to all previous reportsSubscribe Now