The economic calm which had succeeded the turbulent conclusion to 2018 was abruptly shattered on the 16th of September. On that day, rates in the repo markets spiked by 248 basis points to more than double the overnight lending rate of the Fed.

Currently, the Fed is engaged in an epic battle to postpone the collapse of the bubble in financial assets, which it has helped to create. But, while the repo-market is a harbinger of coming financial calamity, it’s not the only ‘canary in the coal mine’.

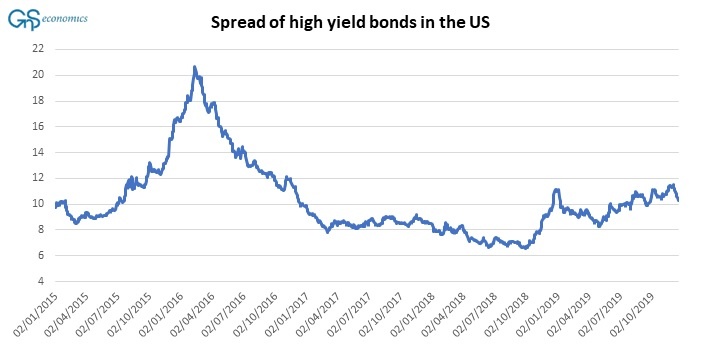

Like the repo-market, credit markets too started to “act-out” in early fall (or even earlier). The nearly $700 billion market for collateralized loan obligations, or CLOs, started to lose value in late summer, and then worsened in October when some securities recorded a loss of over 5 percent. Spreads between high-yield (or “junk”) bonds vs. U.S. Treasuries and investment-grade corporate debt have also been creeping higher since early summer (see Figure 1).

Figure 1. The option adjusted spread of the ICE BofAML US corporate C index over the spot Treasury curve from January 1, 2015, till December 16, 2019. Sources: GnS Economics, St. Louis Fed

During the fall, another opaque corner of the credit markets, the $1.2 trillion leveraged-loan market, started to signal growing stress. It was hit with a deluge of downgrades, outpacing upgrades at a pace last seen in 2009.

The International Monetary Fund has warned that in a global downturn corporate debt at risk of default would rise to $19 trillion in eight major economies. Investors also faced record “duration risk” in the global bond markets.

So, tremors in the credit markets have started. It’s noticeable that the “Not QE” T-bill purchase program the Fed enacted in October has done practically nothing to calm them. This means that the tremors are likely to spread until a full financial market rout commences.

This should not come as a surprise as artificial liquidity from the central banks cannot sustain the markets if the real economy falls away beneath them. This was the big lesson of the ‘Great Crash’ of 1929. Artificial liquidity can, however, sustain the markets longer than real economic fundamentals would suggest, thus making their eventual collapse worse.

This over-extension of the market cycle is essentially what the Fed and other central banks have been engaged in since September. Their desperation is understandable as the coming collapse will not just sow economic calamity but also threaten their very existence (see Q-Review 3/2019 for details).

All the same, they are fighting a losing war. Crisis is coming.

Q-Review 4/2019: A special report on the economic collapse of 2020-2023 is available atGnS Store

Purchase the annual subscription of Q-Reviews (4 issues) including access to all previous reports fromGnS Store