For some years now, we’ve been very wary of the legitimacy of the “economic recovery”. In June 2013, we wrote:

It is possible that the banking sector and the world economy were saved by using too strong methods in 2008. As a consequence of this, it is also possible that the world economy is more like zombie economy, where unprofitable banks and companies are kept alive with easy money and rescue packages from the governments.

We of course could not know back then how right we would turn out to be. Our skepticism arose from the principles of economics, more precisely regarding theories of economic growth and the price mechanism.

The growth in productivity has been the single most important driver behind the relentless rise in living standards during the past 200 years. This has been accomplished by following the principles of capitalist or the market economic model, where households, investors and firms set the price of products, services, interest rates, and financial assets.

After 2008, a relentless attack by global central banks against these fundamental precepts commenced. Central bankers most likely had the best intentions in mind. They wanted to save the global economy and help it to grow. In their erroneous enthusiasm, however, they broke a 200-year old model of economic growth.

The destruction that leads

Long-term economic growth is driven by technical innovations, which improve the effectiveness of production, that is, productivity. What this means is that innovations (from spinning-jenny to industrial robots and beyond) increase the productivity of a human worker thus increasing his wage and making products cheaper. This process is behind the spectacular rise in our living standards since the 18th century.

However, this process assumes a crucial element, creative destruction. It means, simply, that new, more efficient production will replace the old and inefficient. This requires that old firms fail and new firms take their place. It’s also at the heart of the capitalist market economy. The risk-and-reward relationship, that is, the gains and failures of the private sector drive economic progress. The first accumulates income and capital, while the second uncovers sustainable businesses, setting the stage for the creative destruction. Government has an important role in this by setting laws, governing human and property rights and guaranteeing income through social security, but it is ultimately the private sector and markets that drive progress. As socialist market economy experiments have recurrently shown, this risk-and-reward relationship is crucial for creative destruction to work.

Creative destruction thus leads economic growth. The continuous loop of destruction of firms, jobs and income drives the birth of the new and better production, employment and higher income. Creative destruction is the engine of development.

Progress: cancelled

After 2008 global political leaders and central bankers took away—or at least seriously distorted—the risk-and-reward relationship with their bailouts and continuous monetary easing (ZIRP, NIRP) and money-conjuring (QE). The risks were socialized on a scale never seen before, but rewards remained, more or less, private. The pinnacle of this was the Eurozone, where most of the banks were saved during the GFC creating, effectively, a zombified banking sector. The exceptional monetary policy (bailout) operations of the ECB worsened the situation. For example, the OMT program, which the ECB launched in August 2012 to halt the rise of government bond yields, improved the health of banks, but it also led to zombie lending, where weak banks extended loans mostly to low-quality (zombie) companies. Zombie banks fostered the growth of zombie corporations.

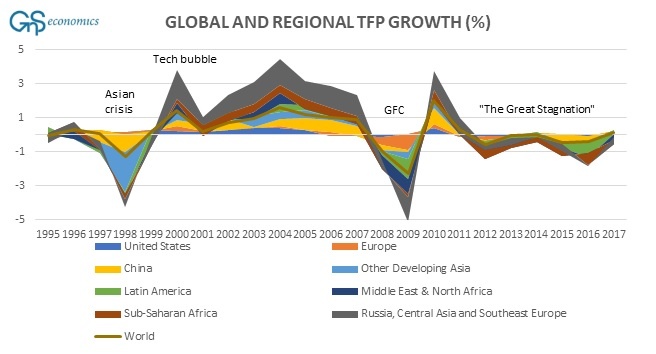

Because of these measures, the process of creative destruction that had guided market economies for the past 200 years was stopped all over the world. This is visible in the growth of total factor productivity, which stagnated in 2011 (see the Figure 1).

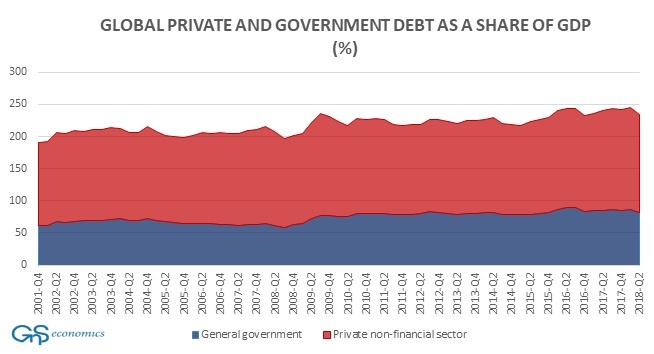

Because productivity growth stagnated, something else needed to take its place as a driver of growth. This was debt, which has grown relentlessly since 2008. Reported government and private non-financial sector debt has reached a massive 250% of global GDP. When one adds the financial sector and the ‘shadow banking sector’, that figure is likely to multiply.

Where to go, when the road ends?

The misguided efforts of politicians and, especially, central bankers have pushed the global credit cycle to ever-new highs since the 1970’s. This last push through money conjuring by the central banks has, some would say finally, broken the global growth model. Nothing rises interminably through the years. Business cycles and recessions have an important role in cleansing the economy of its excesses. Although difficult, they foster economic growth.

Now, with limited resources remaining to push the credit cycle any further, we are at the end of the road. Here, only unpleasant options exist. One is a forced return to the principles of the market economy through the liquidation of the old and inefficient means of production and by reining-in the excess in the financial markets. This course implies, quite simply, the onset of a global depression. The alternative is to continue on the current path and stimulate even more through utterly desperate measures. ’Modern Monetary Theory’ and its ilk promise simple fixes to complex problems. They never work, but offer short-term, politically-popular relief with even more pain later. Money-conjuring always leads to inflated prices, whether in the asset markets or in the real economy, and to inefficiency of production. This should be painfully obvious by now.

Alas, we are at the crossroads. The clock has run out. The jig is up. Whatever path global leaders choose, everyone needs to be prepared, as all options will lead to further and even more serious distortions in the global economy and markets. We’ll return to those in more detail in June.

Buy the full report describing the mechanism why global growth model has failed and why the world economy never recovered from the 2008 crisis. The report also includes economic growth and crisis probability forecasts.

Purchase the annual subscription of Q-reviews to stay informed on the recent developments in the world economy and global markets. Our reports provide constant updates on how corporations, investors and households can prepare for and benefit from the coming economic calamity.Subscribe Now