The world is on the brink of something new. We have been analyzing and detailing the approaching economic crisis since March 2017.

We have shown that central banks are responsible for creating asset bubbles and undermining the foundations of economic growth. These detrimental developments are inching the world ever-closer to an economic crisis, which is likely to be exceptional in both scope and depth.

However, economic crises are not just doom-and-gloom. The reprice a massive swathe of tangible and financial assets creating a risky, but possibly extremely-productive buying opportunity.

The only problem is that the choice of the wrong store of wealth prior to the crisis may seriously hinder, or completely obstruct, the ability to obtain the depressed assets that become available in the depths of the crisis. In the Prepper’s Bunker – report we detail, how investors can preserve liquidity and benefit from the coming crisis.

But, how did we get here?

From a crisis to an ‘everything bubble’

When the world economy hurtled into a global financial crisis in 2008, global authorities and leaders responded decisively. Interest rates were cut, bank deposits were guaranteed, recapitalization was offered to banks and debt-run stimulus programs were issued. These exceptional actions (in scope and breadth) stopped the crisis in its tracks.

However, something was not right. After a brief, and anticipated, bounce from the depths of the crisis, economic growth started to sputter. The global economy was shocked by the European Debt crisis in 2010-2012, but something more fundamental haunted the ailing recovery. With practically no one noticing, in 2011 global productivity growth started to stagnate.

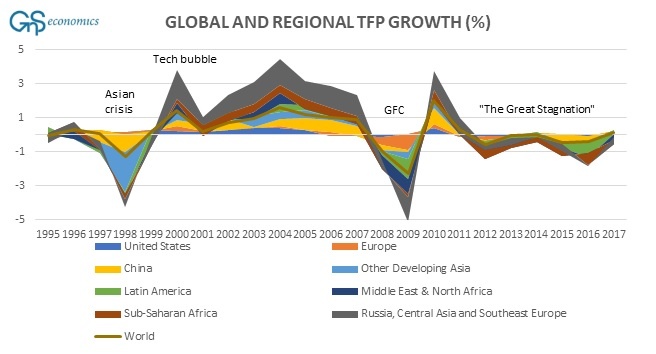

Figure 1. Regional and global growth rates of total factor productivity (TFP) in percentage points. Source: GnS Economics, Conference Board

When an economy grows ‘organically’, capital investments and labor inputs increase production more than their simple addition would entail. This is called productivity growth, and it’s usually driven by technological innovations.

As we detailed in Q-Review 1/2019, this fundamental driving force behind increasing living standards was stopped as the result of constant economic meddling by central banks and political leaders. Cheap, plentifully-available money and bailouts of banks and corporations corrupts the economic system and makes it unable to function optimally.

Moreover, constant market manipulation creates fragile asset markets, which are in constant need of resuscitation, as the latest “jawboning” by Federal Reserve Chairman, Jerome Powell, underlines. If the bull market in assets has been sustained by constant monetary and fiscal support, it will struggle without it.

From record stimulus to global fragility

The ‘Day of Reckoning’ for asset markets almost arrived at the turn of the year. In December, stock and credit markets declined in a way that signaled an approaching collapse. Global authorities panicked. In first days of 2019, the Fed abruptly reversed its “forward guidance” from several expected rate hikes in 2019, and balance sheet reduction on “autopilot”, to the possibility of no hikes at all and the end of the balance sheet “normalization”. The “Powell Pivot” has continued since with promises of possible easing—including the possibility of negative rates— just last week.

Acting before the Fed, the central bank of China had started emergency measures in mid-December 2018 by pushing a record-amount of liquidity into the banking sector. These measures rocked global asset markets back to growth, but the global real economy kept weakening.

The first hints of growing global economic weakness had arrived in late 2018. The Chinese economy seemed to lose momentum along with the ‘growth engine’ of the Eurozone, Germany. But the weakness had been brewing even longer than that.

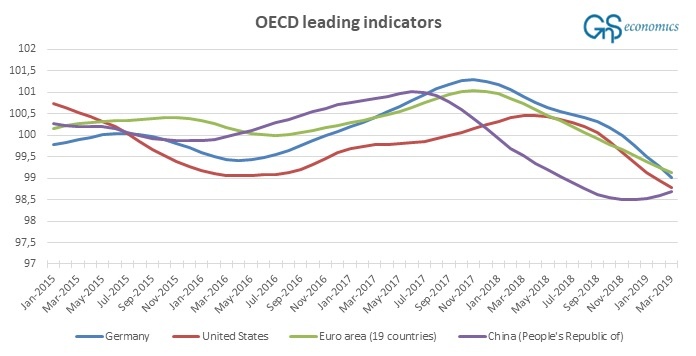

The leading indicators of the OECD show that global economic momentum started to sputter in early 2018 or, in China, even as early as the fall of 2017 (see Figure 2). In October 2017, we warned that the ‘Chinese growth miracle’ was likely to face a protracted slowdown and possibly an eventual crash after the stimulus preceding the 9th Congress of the Communist Party of China, held in mid-October 2017, waned. This seems to have been the starting point of growing global weakness. The turn in the index in early 2019 reflects (the short-lived) record-stimulus China enacted in Q1.

Figure 2. The amplitude adjusted composite leading indicator of the OECD for China, Germany, euro area and the United States. Source: GnS Economics, OECD

From global fragility to (likely) global collapse

While central banks may try to support asset markets by increasing liquidity, it will be a futile effort. Bear markets always come, and asset markets cannot, in the end, escape the gravitational pull of the real economy. And, unfortunately, the longer artificial support for asset markets continues, the greater the likelihood of a full-blown asset market crash when the recession does arrive.

The reason why central banks, in this cycle, have had very little effect on the growth of the real economy is two-fold. First, they have over-played their hand during the past 11-years by constant monetary stimulus which, like all stimulus, loses effectiveness over time. Secondly, the current global expansion has been driven by China, which has been responsible for around 55% of all new money (credit) created globally as well as some 52% percent of all capital investments in major industrialized nations since Q1 2009. Because China has achieved this through never-before-seen levels of debt stimulus, it has made itself and the global economy dependent on a continuing debt binge. This, quite obviously, is a highly unsustainable combination.

As the global slowdown has been in motion basically since the end of 2017, it really has very little to do with current trade issues between China and the US, monetary tightening by the Fed or lack of fiscal support in the Eurozone. No, the global expansion has, quite simply, reached the end of its lifespan. In fact, without the fiscal stimulus enacted by President Trump, we most likely would already be in a recession.

The bunker?

The most pressing problem for investors is that because of the ‘unorthodox measures’ of the central banks, the entirety of the global bond universe—both government and corporate—is in a massive bubble. Because the bond markets have such an important role in corporate financing as well as providing global liquidity, declining prices and defaults could easily contribute to the collapse of the global economy.

The real risk in this cycle has never been stock market valuations, but the bond market. It is probable that the rapid deterioration in the credit markets is actually what alarmed Chairman Powell and the FOMC in late 2018 (though the Fed was certainly under intense political pressure to “fix” the stock market.)

It’s quite obvious that the ‘everything bubble’ has greatly diminished the number of ‘safe havens’ and other crisis-prone hiding places. But the scope of this bubble and the sheer magnitude of market manipulation by the central banks has made the situation even worse.

This time, the looming collapse does not just threaten banks or money markets, but sovereign nations. When the pricing of risk is as skewed as it is now, current prices in the capital markets do not reflect the true risk of underlying assets, but rather the level of manipulation.

In our latest report, we explain the likely crisis dynamics, present the building blocks of the “bunker” for investors, and present options for investors to preserve liquidity during the economic crisis. We will also continue to monitor the road to the crisis, its likely aftermath, and the options for preparation in our forthcoming Q-Review reports.

Buy the “Prepper’s Bunker” -report fromGnS Store

The annual order of our Q-review reports is availableSubscribe Now

Prepper’s bunker, table of contents:

The tale of four crises

The prepper’s bunker

Lessons from history

Depression

Systemic meltdown

Bailout/inflation

General guidelines for crisis investing

Forecasts

Conclusions

Appendix I: Figures

Appendix II: The best performing stocks during and after crises