In this blog, we present the anatomy of a financial crisis. A characteristic feature of a banking crisis is that it tends to follow, more-or-less, the same path regardless of the ‘shock’ or ‘trigger’ that initiates it.

The next phase of the crisis is likely to be a global financial crisis, as we have been anticipating for quite some time (see, e.g., Q-Review 4/2017). However, few understand what a financial crisis is, though it is probably among the most feared economic phenomena of mankind.

So, let’s dive in.

The initiation

If a banking system is sound and robust, it can usually withstand financial and economic shocks.

But a banking system may be fragile. Usually this is due to high leverage levels, where banks have either lent aggressively or carry risky financial investments on their balance sheets—usually both. Banks can also have a weak financial position, with chronically low profitability and insufficient reserves. As we have explained earlier, this is exactly the state the European banking sector finds itself in.

The onset of a financial crisis requires a trigger. The most common is a recession or the expectation of recession among consumers and investors.

Recession leads to diminished income and defaults by both corporations and households. This increases the share of non-performing loans in bank loan portfolios, reducing the value of loan collateral and increasing bank risks and capital needs. As write-downs and losses increase, mistrust among other banks and depositors and investors does as well. The bank’s share price will usually start to reflect this.

A ‘bank run’

If suspicion spreads, banks will be apprehensive about counterparty risk and will be unwilling to lend to one another even on an overnight basis. If allowed to continue, this will have a calamitous impact on liquidity in money markets.

In the worst case, possibly fueled by rumors and insider information, a ‘bank run’ will ensue, where depositors try to withdraw their money suddenly and simultaneously. In years past, depositors would queue outside of bank offices to obtain cash. Now withdrawals are largely electronic.

At the same time, the bank’s investors and institutional counterparties rush to lower their exposure by frantically selling its stocks and bonds as well as derivatives and other interbank liabilities. If this continues, trust in the bank is broken, and it fails. Growing speculation about the financial health of both sound and unsound banks, combined with funding issues, eventually triggers a system-wide banking crisis.

In history, there have been many different triggers for financial calamity. The trigger for the Great Depression of the 1930s was a recession, which first crashed the U.S. stock market in October 1929 and then started the banking crisis in October 1930. The financial crisis of Japan in the 1990s started from an asset market crash in 1990. The recent Global Financial Crisis had several triggers including the collapse of the “High-Grade Structured Credit Strategies Enhanced Leverage Fund” sponsored by investment bank Bear Stearns in June 2007, and ultimately the collapse of the venerable investment bank Lehman Brothers on 14th October 2008.

The response

What follows the initiation of a banking crisis—which often starts with just one bank—is dependent on the general condition of the banking sector and the response of authorities.

Bank regulators can take over the failing bank, ensure the payment of deposit guarantees, and arrange for the merger or acquisition of the ailing bank by a stronger financial institution. This well-established process provides that bank customers—depositors and borrowers—are protected while equity owners, management, and some, or even all, creditors rightly bear the losses. A central bank will usually provide liquidity to facilitate this. If the problems in the banking sector are limited to one bank, such measures may be sufficient to stem the panic.

However, if the banking sector as a whole is compromised or suffering from a significant enough economic shock, even sound policies may not be enough to cover losses of banks and depositors leading to sector-wide bank runs.

The implications

In a banking crisis, credit will become restricted and credit lines are likely to be withdrawn—especially those to enterprises. In the worst case, authorities will be able to rescue only certain banks or only save depositors, which occurred in Iceland in 2008/2009. When the banking sector collapses, it means that the economy faces a serious credit depression, where the availability of credit become diminished to a significant degree.

When the banking crisis is global, as it will be this time around, access to credit will be restricted globally, with hedging activity sharply curtailed as a result. For example, from 2007 to 2008, global gross capital flows plunged by 90 percent.

The availability of so-called “freight derivatives”, which are used by end-users (e.g., ship owners and grain houses) and suppliers (e.g., international trading companies) to mitigate the risk of shipments, may face a collapse. This would mean a serious reduction in, or even a complete halt to global freight activity. While it’s impossible to evaluate, precisely, how serious the impact of a collapse in the availability of these derivatives would have on global freight, we have to assume that it would be large, because manufacturers will not ship without adequate insurance.

In the case of a global financial crisis we therefore have to be prepared for:

- Collapse of asset markets.

- Collapse in global availability of credit and banking services.

- Collapse in global demand.

- Collapse of global freight.

- In the worst case, the collapse of the global financial system (a global “systemic crisis”).

The coming crisis

The European banking crisis has been brewing for some time. It is also likely to go global, as Europe holds the largest concentration of global, systemically important banks (G-SIBs). Italy and Spain, but also Germany (Deutsche Bank), are the countries to keep a close eye on.

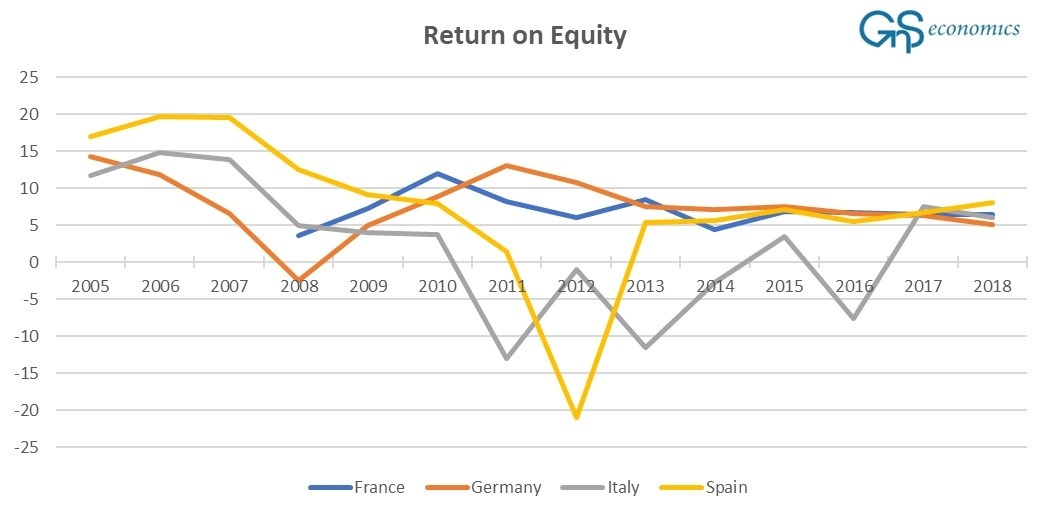

Return on Equity (RoE) of the European banks has been dismal since the GFC (see Figure 1). This is mostly for two reasons. First, the toxic assets, like CDOs, were allowed to remain and compromise the balance sheets of European banks after the GFC. Secondly, the misguided policies of the ECB (OMT, negative interest rates and QE) led to the deterioration of the profitability of the European banking sector.

Figure 1. Return on Equity (RoE, net income minus shareholders’ equity). Source: GnS Economics, IMF

Now, due to the recession, which started in the Eurozone in Q4 2019, and the severe economic impact of the coronavirus, the non-performing (bad) loans of Italian and Spanish banks are expected to skyrocket from a level that was already considerably higher than pre-GFC (see Figure 2).

Figure 2. The share of non-performing loans to gross loans. Source: GnS Economics, IMF

There is practically no way that the Italian and—likely—Spanish banks can remain standing against the hurricane-force of these accumulated economic losses.

The onset of a European banking crisis is close, and it should worry us all.

More information

Learn how to prepare for the coming crisis with the help of our Crisis Preparation- series.

Annual subscriptions of our Q-Review reports and Deprcon Service are available at GnS Store