The Stages of the Collapse

In this constantly updating blog -post, we follow the path of the crisis put in motion by the coronavirus.

In this constantly updating blog -post, we follow the path of the crisis put in motion by the coronavirus.

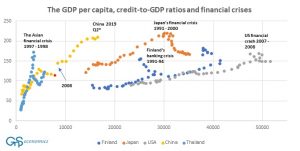

The outbreak of the coronavirus epidemic in China has shaken the global asset markets—and with good reason.

The coronavirus has the potential of being the ‘trigger’ which will push the world into a global depression. Here, we briefly explain why.

…

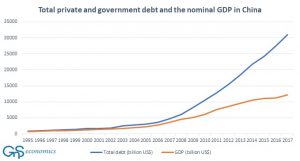

We have been following China closely for nearly four years. We first warned about the unsustainability of China’s growth in March 2017 and have continued to issue w…

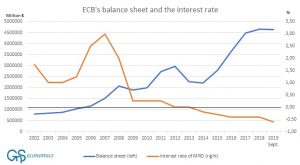

The economic calm which has succeeded the turbulent conclusion to 2018 was abruptly shattered on the 16th of September. On that day, rates in the repo markets spiked by 248 basis points to more than double the overnight lending rate of the…

One thing has been bothering us for six years. How can so many economists and economic commentators dismiss the ever-increasing market meddling of central banks so lightly?

The first time we warned about this possible threat to financial markets w…

We have been monitoring China closely since March 2017. We were one of the first to show that China had driven the global business cycle since 2009 and that the rem…

The U.S. has been an exception in a slowing global economy for the past year. However, it cannot escape the coming global recession and economic collapse.

The world economy has not been in a more precarious situation in over a decade. Growth is faltering everywhere, with the Eurozone flirting with recession, while central banks have returned to monetary easing after just one year of global tightening.

For some reason, the dire situation of European banks is not causing further alarm. This is strange, as it is the exact place where the new global banking crisis is likely to start.

What makes it even stranger is that recession is approaching the …

The European Monetary Union (EMU) has been a bold, but fundamental flawed experiment. It has sown the seeds of divergence in economic well-being, politics and it has “zombified” the banking sector in Europe. For investors, it has created the possibil…

There is renewed hope in the markets after central banks, most-recently the ECB and China, have added easing measures. The working narrative is that these will, once again, renew global growth and allow governments, corporations and consumers to go e…

A recession is approaching. Almost anywhere in the world one looks, economic indicators are in decline. As we have argued since March 2017, the coming recession wil…

Recent Posts

Archives

Categories

RSS

https://gnseconomics.com/en/feed/